Nobel laureate economists and institutions like the World Bank and the Organization for Economic Cooperation and Development endorse pricing carbon as an important and cost-effective tool to bring down emissions and improve public health without harming the economy.

Real-world data shows that putting a price on carbon pollution in B.C., Alberta, Quebec and California, as well as countries like Sweden (with the world’s highest price on pollution), does not hurt economic performance. These jurisdictions are growing clean tech and renewable energy industries, not to mention improving air quality.

So what is going on in Saskatchewan? Saskatchewan’s government is challenging the federal government in court in February over its plan to implement a tax on greenhouse gas emissions. (Note: the David Suzuki Foundation is supporting carbon pricing as an intervener in the case.) Saskatchewan opposes the federal plan, in part, because it claims the economic costs of the carbon tax would be catastrophic. A news release claims the carbon tax will mean $16 billion in lost productivity by 2030.

Jotham Peters, a managing partner with Navius Research, Inc., took a close look at the analysis commissioned by the Saskatchewan government and found it faulty.

The study, by the University of Regina’s Institute for Energy, Environment and Sustainable Communities, is difficult to interpret. It uses key terminology inconsistently and contradicts results in various sections. The government appears to have misunderstood and misreported the findings. As a result, the impacts of a carbon tax have been vastly overstated.

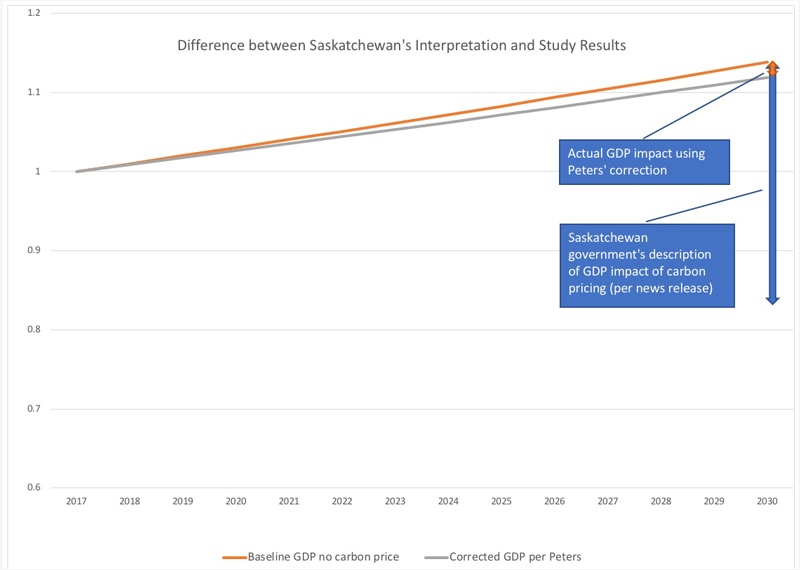

The government release claims the federal carbon-pricing system would reduce the province’s GDP by 2.43 per cent (from a baseline of 1 per cent growth) and shrink the economy by $1.8 billion a year. These huge GDP reductions, the government says, will lead to “less competitive industries in Saskatchewan and fewer jobs across the province.”

The Saskatchewan government appears to have confused GDP growth for total GDP. That would be like confusing a car’s rate of acceleration with its speed.

A GDP contracting at 1.43 per cent annually, Peters notes, would be unprecedented in the recent experience of developed countries. In Canada, we would need to go back to the 1930s Great Depression to see an equivalent. In the case of European countries, only during the world wars and the Spanish Civil War were there more devastating recessions.

It’s all the more surprising that such high impacts are being claimed when one considers that by 2022, a carbon tax would only increase the price of gas by $0.12 per liter (the kind of price increase Canadians can see at the pumps on summer long weekends).

The economic model used for the institute’s study is commonly used by banks, economic forecasters and others assessing the impact of carbon pricing. It’s my experience that if the scheme is well-designed, model outputs tend to show very slight effects on overall GDP. The benefits of acting on climate are shown to be much greater than the costs.

Peters found the government likely made a huge mistake in reporting the study’s results. It appears that two big reporting errors compounded into an even larger error.

The Saskatchewan government appears to have confused GDP growth for total GDP. That would be like confusing a car’s rate of acceleration with its speed.

While the news release claims that a carbon tax “would reduce provincial GDP by 2.43 per cent annually” the report implies the tax would instead reduce the provincial GDP growth rate by 2.43 per cent. In other words, the economy would still grow, but just a little more slowly.

Peters found that the institute’s supporting analysis suggests a reduction in the rate of economic growth of a much smaller — and far more realistic — 0.13 per cent from 2017 to 2022. GDP goes from growing at an anticipated one per cent to growing at 0.87 per cent. That’s hardly a recession. Other top Canadian researchers support Peters’s analysis.

I have adapted Peters’s graph to show the slight impact the carbon tax would have on Saskatchewan’s GDP compared to a scenario where carbon is not priced.

The Saskatchewan government should own up to its mistake and put the institute’s report out for peer review. Only with accurate numbers can we have a robust and meaningful public discussion about carbon pricing.

It is unfortunate that the Government of Saskatchewan instead launched a court case to purportedly protect its economy from huge economic impacts. The study it relied on — if read carefully — shows that the provincial economy would adapt to a price on carbon pollution without major economic dislocation.

Put a price on climate pollution! Tweet the environment and climate change minister

Our work

Always grounded in sound evidence, the David Suzuki Foundation empowers people to take action in their communities on the environmental challenges we collectively face.