An LNG site in Kitimat, B.C. (Photo: Province of British Columbia via Flickr)

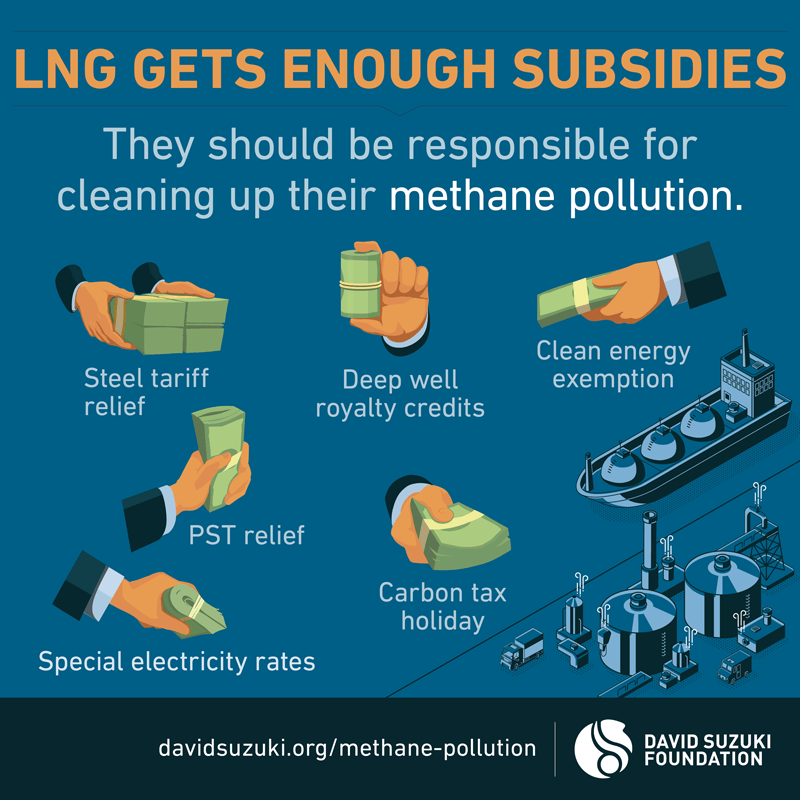

How many times have you heard that liquefied natural gas development will give B.C. communities the tax revenue they need to pay for hospitals, schools and other public necessities? The reality is that government subsidies to fracked liquefied gas in the province are propping up the industry and royalties are so low that they aren’t trickling down to communities.

The B.C. government charges oil and gas companies extremely low royalty rates to encourage the industry in the midst of falling gas prices driven by a U.S. fracking boom. Worse, while the volume of natural gas extracted has grown, royalties have dropped. In 2008, when gas prices were higher, the B.C. government collected $1.16 billion in royalties. In 2017, it collected just $147 million, even though 41 per cent more gas was extracted. The province has also cut leasing rates on Crown land tenures where companies have the right to drill wells.

Over the past decade, B.C. has missed out on about $5 billion in royalty revenues because of credits the B.C. government gives for most fracked wells. These credits were designed to help companies when the technology for drilling deep wells into formations for fracking was new. Now it’s standard and costs for drilling deep wells have dropped dramatically, yet the subsidies remain. Oil and gas companies have reduced the amount they owe in royalties by over 60 per cent and they’ve built up current credits of over $3.2 billion to reduce royalty payments, as documented in the B.C. budget.

The industry has also avoided paying carbon taxes on methane leaked or vented into the atmosphere. Based on the Foundation’s research, in 2015 for example, the B.C.’s oil and gas industry avoided paying more than $146 million in carbon taxes for methane pollution¹.

The massive $40-billion LNG Canada Kitimat plant, supported by B.C. and federal governments, plans to ship 13 megatonnes of LNG each year. Assuming industry leakage rates of 1.33 per cent², and reducing this by 45 per cent to account for new regulations, one plant alone will result in the emissions of more than 40,000 tonnes of methane. Since methane has a greater impact on global warming, this equals one million tonnes of CO2 sent into the atmosphere, implying at least another $30 million in carbon taxes avoided.

The oil and gas sector is a well-established, highly profitable industry that should be paying its fair share for the publicly owned resources it extracts and the damages it causes.

Emissions from the first phase of the LNG Canada project — mostly to run natural gas–fired compressors — are projected to be 3.45 million tonnes of CO2. While by 2022 most B.C. residents will pay a carbon tax of $50 on their carbon pollution, LNG Canada will qualify to get $20 per tonne of its tax payments refunded if it meets a performance standard. This is worth $69 million per year.

LNG Canada is also benefiting from a billion dollars of federal relief from steel tariffs, PST exemptions during the construction phase and preferential electricity rates. For the preferential electricity rates alone, the province promised savings worth between $56 and $83 million dollars annually.

Companies are also passing on the escalating costs of responding to climate change to the public. In 2012, B.C. exempted energy used to power LNG facilities from the Clean Energy Act requirement that new energy generation be zero carbon. Instead of using electricity, compression and refrigeration processes can be powered using gas, which significantly increases carbon pollution.

The subsidies used to prop up the LNG sector are public funds taken away from other sectors like health care. The Ministry of Health projects that the total cost of the new 107-bed patient care unit and extensive renovations to the Royal Inland Hospital in Kamloops will cost $417 million. Many hospitals could be upgraded every year if the LNG industry wasn’t receiving so many subsidies. The oil and gas sector is a well-established, highly profitable industry that should be paying its fair share for the publicly owned resources it extracts and the damages it causes.

¹ Based on correcting province-wide emissions from 78,000 using the actual emissions factor for the Montney of 2.5 x the inventory figure, gives 195,000 tonnes of methane, equivalent to 4,875,000 tonnes of CO2. With a carbon tax of $30, this works out to $146 million.

² Emission factor quoted from Pembina – Considering CH4 emissions only from: Field Production, Processing and Transmission and Distribution – Table 3-44. EPA. US Greenhouse Gas Inventory 2013: Chapter 3

Our work

Always grounded in sound evidence, the David Suzuki Foundation empowers people to take action in their communities on the environmental challenges we collectively face.